Programmatic audio advertising has surged in recent years, with 57.9% YoY growth from 2021-2022. Advancements in programmatic targeting are opening the door to new ways for brands to connect with their audiences.

U.S. adults spend one fifth of their daily digital media time with digital audio, and users no longer need to be sitting at a screen or tied to a specific device to be engaged. Audio ads can occur anywhere, whether a user is engaging with online content or going through their daily tasks listening to their favorite playlist or podcast playing in the background. And as the popularity of streaming services and podcasts continues to soar, advertisers have recognized the untapped potential of programmatic audio to engage users.

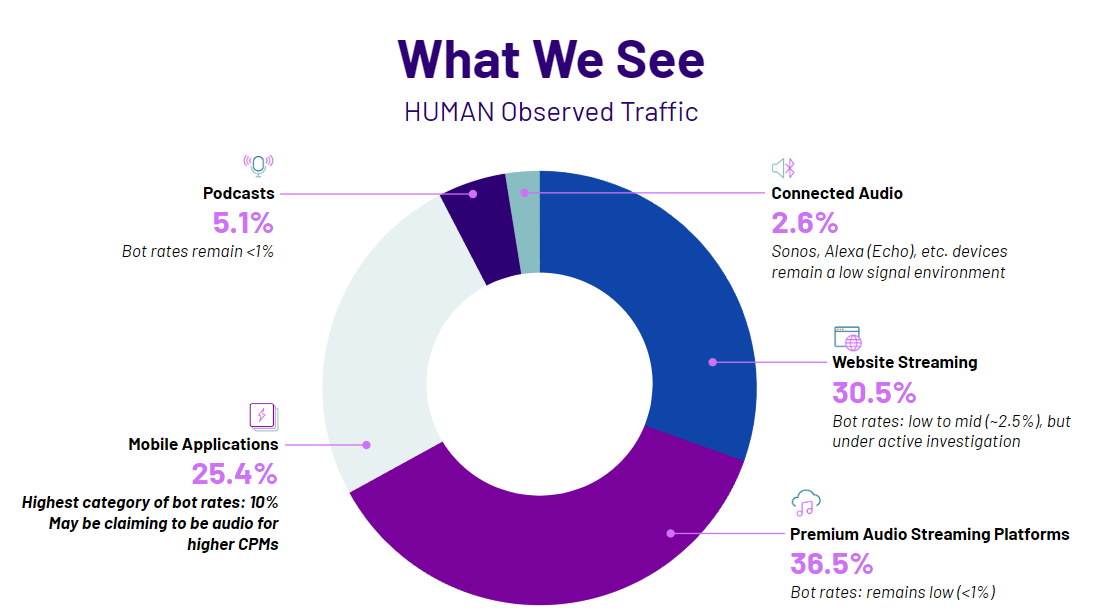

While audio mirrors CTV in several ways, the fact that audio ads can occur anywhere makes the environment that much more complex. Contrary to popular belief, audio isn’t just podcasts, connected audio (i.e. Alexa and Sonos), and streaming on Spotify or Pandora. The majority of audio traffic we see at HUMAN is actually served on Mobile or Desktop, such as music and radio streaming. The fact that all of these diverse traffic types are considered audio makes the term “audio” unique.

The Types of Audio Traffic

At HUMAN, to simplify the audio landscape and the traffic we see, we have roughly categorized audio traffic into five categories. This language has been created to enable open conversations about which types of traffic are driving the strongest bot rates. In the future, we hope to partner with the industry to develop a standardized taxonomy that can be used more broadly.

- Audio Streaming Platforms - Common premium publishers like Spotify, Apple Music, Pandora, and iHeart Radio. These sites typically command the most significant share of audio traffic due to the popularity of on-demand music streaming.

- Mobile Applications - Non-music-streaming app traffic, including ordinary gaming apps like solitaire or coloring book-style apps. Apps typically make up a less significant share of total digital audio traffic.

- Podcasts - Popular podcasting sites like Apple Podcasts and Stitcher. Podcasts have been growing in popularity and could represent a notable share of audio traffic, particularly among users seeking long-form, on-demand audio content.

- Connected Audio - Connected devices such as Sonos and Alexa. These devices contribute to audio traffic by enabling users to access music, podcasts, and other content through voice commands and streaming services. Their share of total audio traffic depends on the adoption of those devices.

- Website Streaming - Smaller audio sites, such as local radio stations, with minimal audio traffic. These sites have niche followings and their share of total audio traffic is often smaller compared to major streaming platforms.

Audio Bot Rates by Traffic Type

The types of audio traffic that HUMAN observes might not be what you think. Across all HUMAN observed traffic, the majority of audio traffic comes from premium audio streaming platforms such as Spotify and Pandora. These premium platforms have low rates of fraud, hovering at just below 1%. Mobile apps and other web, including streaming and miscellaneous traffic, are really the wild west where HUMAN sees the majority of fraud.

As seen above, while mobile applications only make up a quarter of the total observed traffic, they have the highest bot rates of the lot - with bot rates topping 10%. The reason for this? One of the many tricks up fraudsters' sleeves is spoofing. In this case, we see standard mobile applications—for example a poker or drawing app—pretending to serve audio inventory to capture higher CPMs, and thus, more money.

Today, podcasts and connected audio make up a very small portion of HUMAN observed traffic and remain low signal environments. As discussed at a recent HUMAN roundtable, programmatic in podcasts remains nascent. While a video is streamed and an ad can be verified at the time of viewing, a podcast is often downloaded, and programmatic ads are inserted at the time of the download. Ads are listened to offline, if it all, meaning the metrics gathered are only about whether the ad was even available, let alone listened to, making detection and verification in this environment that more challenging.

Staying One Step Ahead

Today HUMAN observes 85% of all programmatic impressions, giving us unprecedented visibility across the ecosystem. With this, we are able to understand what fraud looks like across all environments. The bad actors committing fraud in other environments are expanding to audio fraud to capitalize on the nascent verification and standards and high CPMs. Given we’ve seen them before, we can more easily identify the tactics, techniques, and procedures of fraud across formats.

While the same actors are shifting to audio, their threat patterns differ and evolve with the environment. Our Satori Threat Intelligence and Research team analyzes the data for emerging threat patterns to develop new SIVT detection techniques. In the past year, we have seen a significant increase in our threat detection in audio, which now has an even higher IVT rate (as a percentage of total bid requests) than CTV.

Fraud can’t be fought alone; industry collaboration is critical to increase standards and telemetry in this environment. HUMAN is dedicated to protecting the integrity of the internet and the authenticity of audio. By partnering with the IAB Tech Lab and TAG, HUMAN works to define industry standards and advocate for adoption to protect the ever-evolving ecosystem.